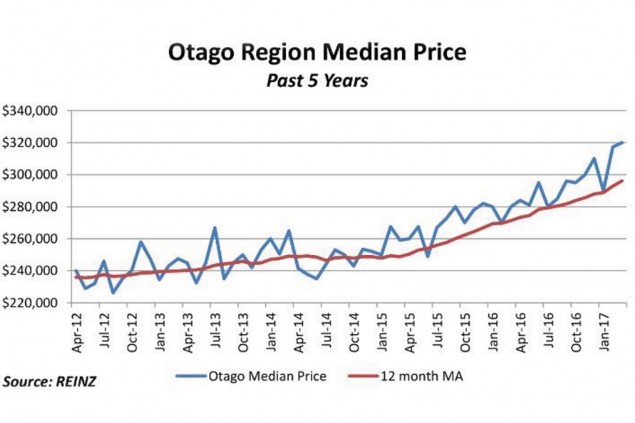

Otago market chalks up another record median price

The Otago market reached yet another record high median price during March – $320,000, compared to $280,000 in March 2016.

The latest Real Estate Institute of New Zealand (REINZ) statistics show the average number of days to sell a property in Otago (Dunedin, South Otago and North Otago) was 20 days – well below the 10 year average of 32 days. Furthermore, across the region, there were 11 weeks of inventory – a 25% drop on a year earlier. Commentators report that strong demand continues from out-of-town investors, particularly from Auckland.

Dunedin

Dunedin city’s median property price for March 2017 was $342,850 – up 12% on March 2016’s average of $305,000. This was based on 259 and 277 sales, respectively.

Central Otago

The March 2017 median price for Central (excludes Queenstown) was $572,500 – up 9% on 12 months earlier, when it was $525,000. The number of sales were also up: 88 in March 2017, compared to 73 in March 2016.

South Otago

In South Otago, the median price was $180, 000 for March 2017 – down 8% on 12 months earlier. The number of sales were identical between the two months, at 32.

Nationwide situation

During March – the busiest real estate month of the year – the market reached its peak level of activity for the year so far, as median house prices firmed and sales volumes rose strongly across New Zealand. The national median house price rose $51,000 (+10%) year-on-year. Compared to February, the national median house price also rose $51,000 (+10%). Nationwide, eight of 12 regions hit new record high median sale prices. The number of sales for March 2017 was 8504, an increase of 36% on February, although down 11% compared to March 2016. REINZ Chief Executive Bindi Norwell says Auckland reached another record median price and a 66% jump in sales volumes on February. “But it should be noted that the ‘March effect’ is more pronounced in Auckland than in other regions. Further, the level of inventory in Auckland is rising quickly, with 47% increase in inventory over the past month, offering buyers more choice.”

House Price Index launched

Developed in partnership with the Reserve Bank of New Zealand, REINZ has launched a House Price Index (HPI). The index provides a greater level of detail and understanding around housing activity over time. It does this by analysing how prices in a market are influenced by a range of attributes (such as land area, floor area, number of bedrooms, etc) to create a single, more accurate measure of housing activity and trends over time. The index uses unconditional sales data (when the price is agreed) rather than at settlement, which can often be weeks later. It is therefore more accurate and timely. Bindi Norwell describes it as ‘the gold standard’ in New Zealand house price analysis tools. When applied to the March data, the HPI indicates that the median price lift was largely driven by changes in the underlying mix of dwellings sold in March, compared to February. While the median price went up $51,000 across New Zealand, the HPI was stable month-on-month – no percentage change – indicating more sales in higher price brackets, than lower ones. “Furthermore, the HPI numbers are backed by anecdotal evidence from around the country saying that investors and first home buyers are facing more challenges in securing bank lending, compared to this time last year. This is lowering the number of dwellings sold in the lower price bracket. As a result, there are comparatively more sales in higher price brackets, which is lifting the median price. Although this gives the overall impression of rising prices, the underlying data shows that the median is moving more due to differences in the mix of dwellings being sold each month.”

Property Management: “Get a Room” flat list due out next month >>

Property Management: “Get a Room” flat list due out next month >>

A desirable neighbourhood since the 1850s >>

A desirable neighbourhood since the 1850s >>

Edinburgh Realty Art Awards: Entries open this month >>

Edinburgh Realty Art Awards: Entries open this month >>

Six top tips: House and contents insurance >>

Six top tips: House and contents insurance >>